Why Managing Debt Feels

Harder Than Ever

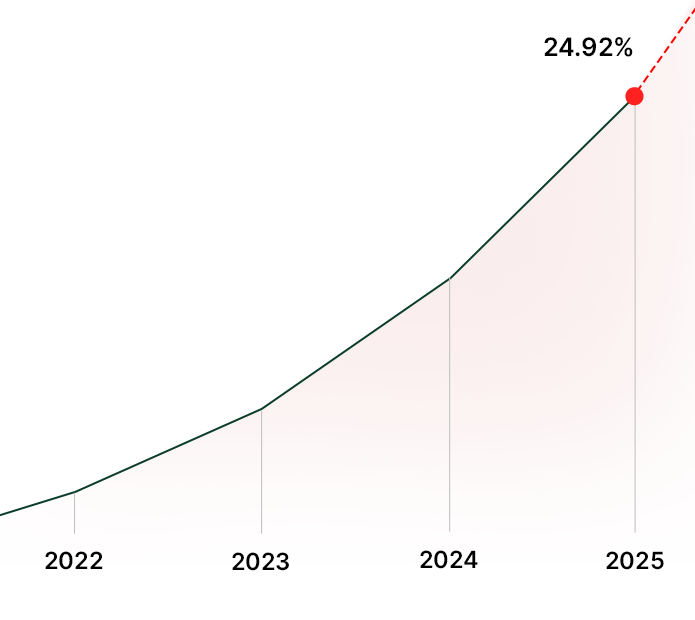

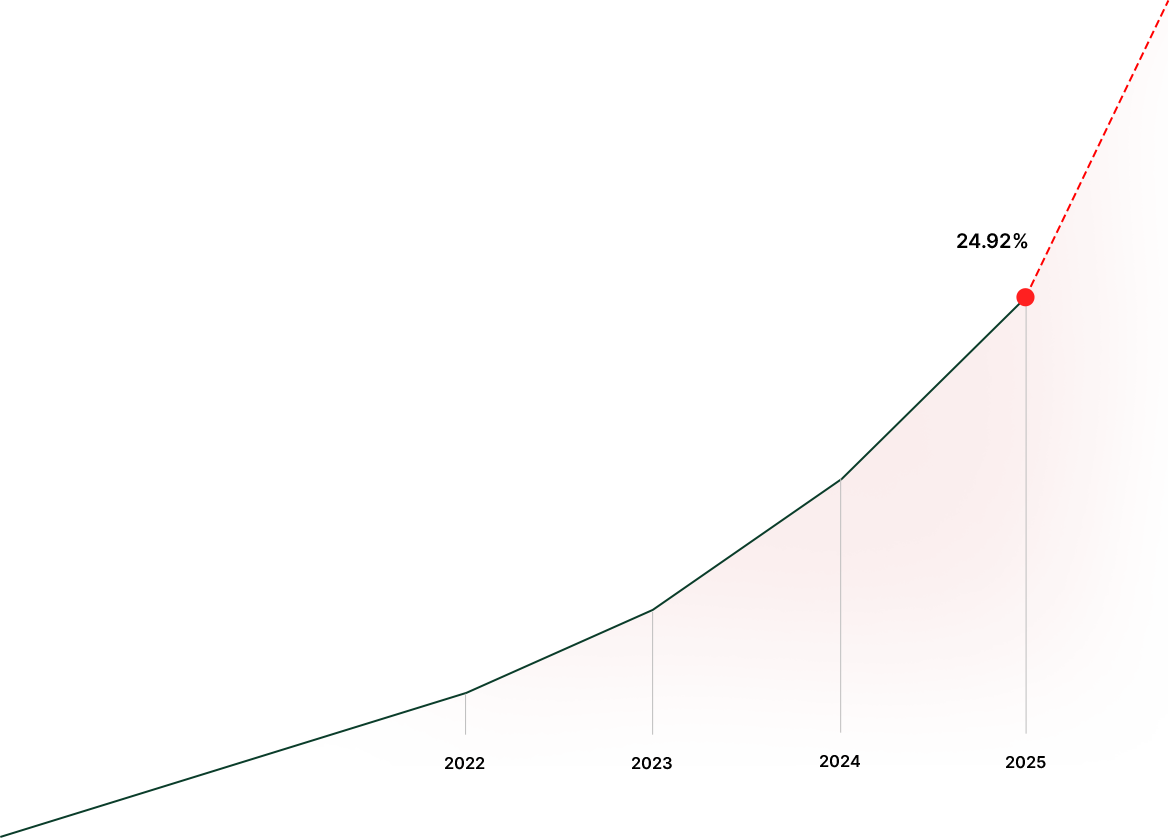

Over the last several years, rising interest rates & increasing living costs have made everyday finances more difficult to manage. For many households, debt balances are growing faster than they can be paid down even when payments are made on time.

Credit Card Interest Rates Keep Climbing

U.S. commercial bank interst rates on credit card plans, 1995 to 2025

Too many bills

& due dates

High interest

slowing progress

Payments with little

balance relief

Constant

financial stress

Credit Card Interest Rates Keep Climbing

U.S. commercial bank interst rates on credit card plans, 1995 to 2025

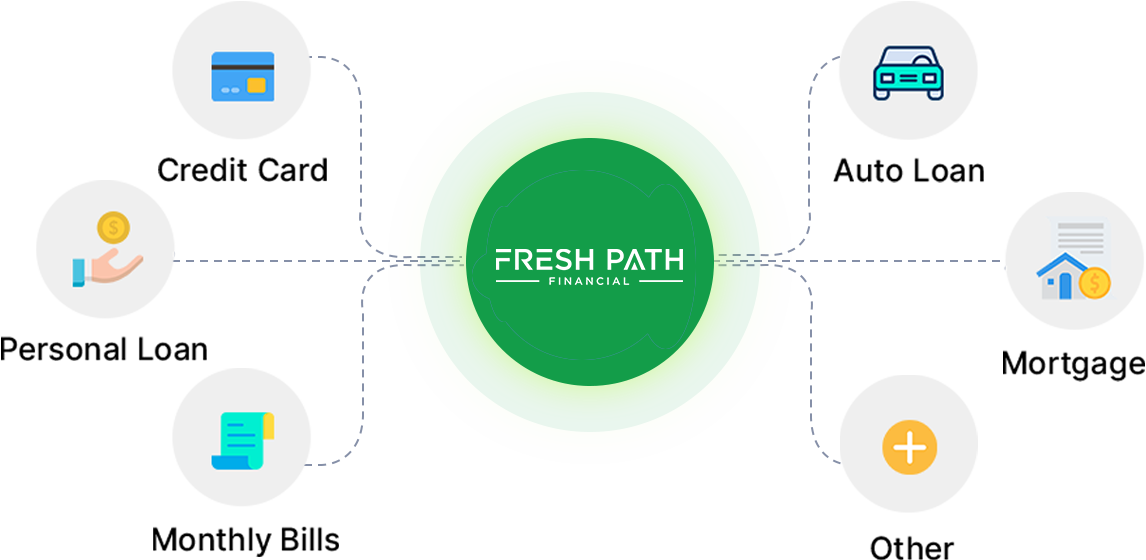

We Help Manage Your Debt

With Clarity & Control

We help turn multiple balances into one structured payment designed to make debt easier to manage.

By reducing the number of due dates and accounts to track, many individuals find it easier to stay on

course and regain control of their finances.

Turn Financial Chaos Into Clear Order

Performance

Personal Loan

Credit Card

Auto Loan

Monthly Bills

One Monthly Payment.

One Clear Plan.

Managing debt becomes easier when everything is organized in one place.

By consolidating eligible balances into a single payment, many individuals find it easier to stay consistent, avoid missed payments, & regain confidence in their financial decisions.

Clarity leads to control and control

leads to progress.

Manage All Your Debt

In Just 3 Simple Steps

01

Share a Quick Overview

Provide basic details about your current debts through our secure form. This step is fast and does not affect your credit score.

02

Review Your Options

We review your information to identify consolidation options that may be available, presented clearly so you can understand them.

03

Move to One Organized Payment

Eligible balances are consolidated into a single, structured monthly payment designed to simplify management and improve consistency.

Why Families Trust Us

With Their Finances

Real-World

Focus

Built around your actual obligations and priorities.

Clear

Expectations

Know what to expect at every step before moving forward.

Built-In

Flexibility

Designed to adapt as your financial situation changes.

Time

Respect

A streamlined process without unnecessary steps.

Professional Discretion

Handled with care, confidentiality, and professionalism.

Our focus is helping people

make informed choices

not pushing quick decisions.

Frequently Asked Questions